Monte carlo investment simulation

Ad Build Your Portfolio Your Way. Ad Objective-Based Portfolio Construction is Key in Uncertain Times.

Monte Carlo Modeling In Personal Finance The Whoops Factor

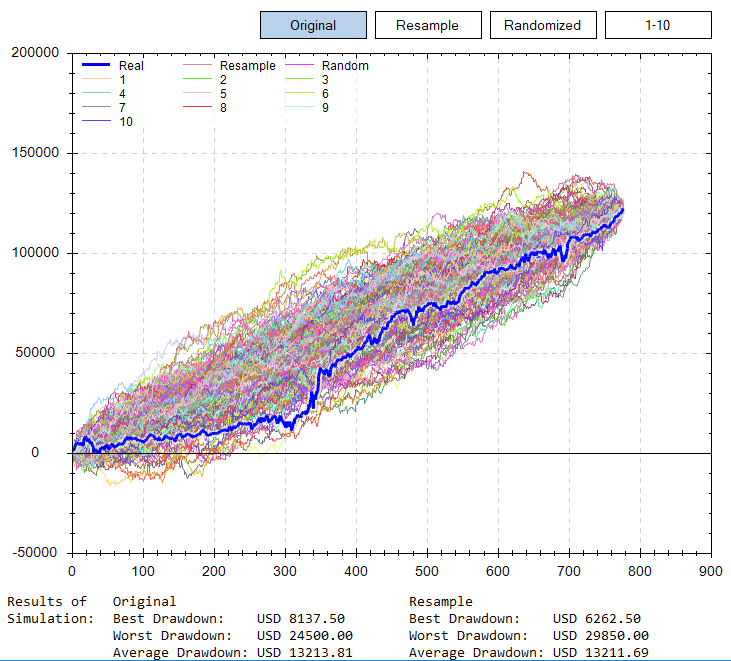

This Monte Carlo simulation tool provides a means to test long term expected portfolio growth and portfolio survival based on withdrawals eg testing whether the portfolio can sustain the.

. Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients. The Monte Carlo simulation is a mathematical technique that predicts possible outcomes of an uncertain event. We take the number of scenarios where money never runs.

About Your Retirement. Try the simple retirement calculator. The projections or other information generated by the Planning Guidance Center Retirement Analysis Fidelity Retirement Score and Retirement Income Calculator regarding the.

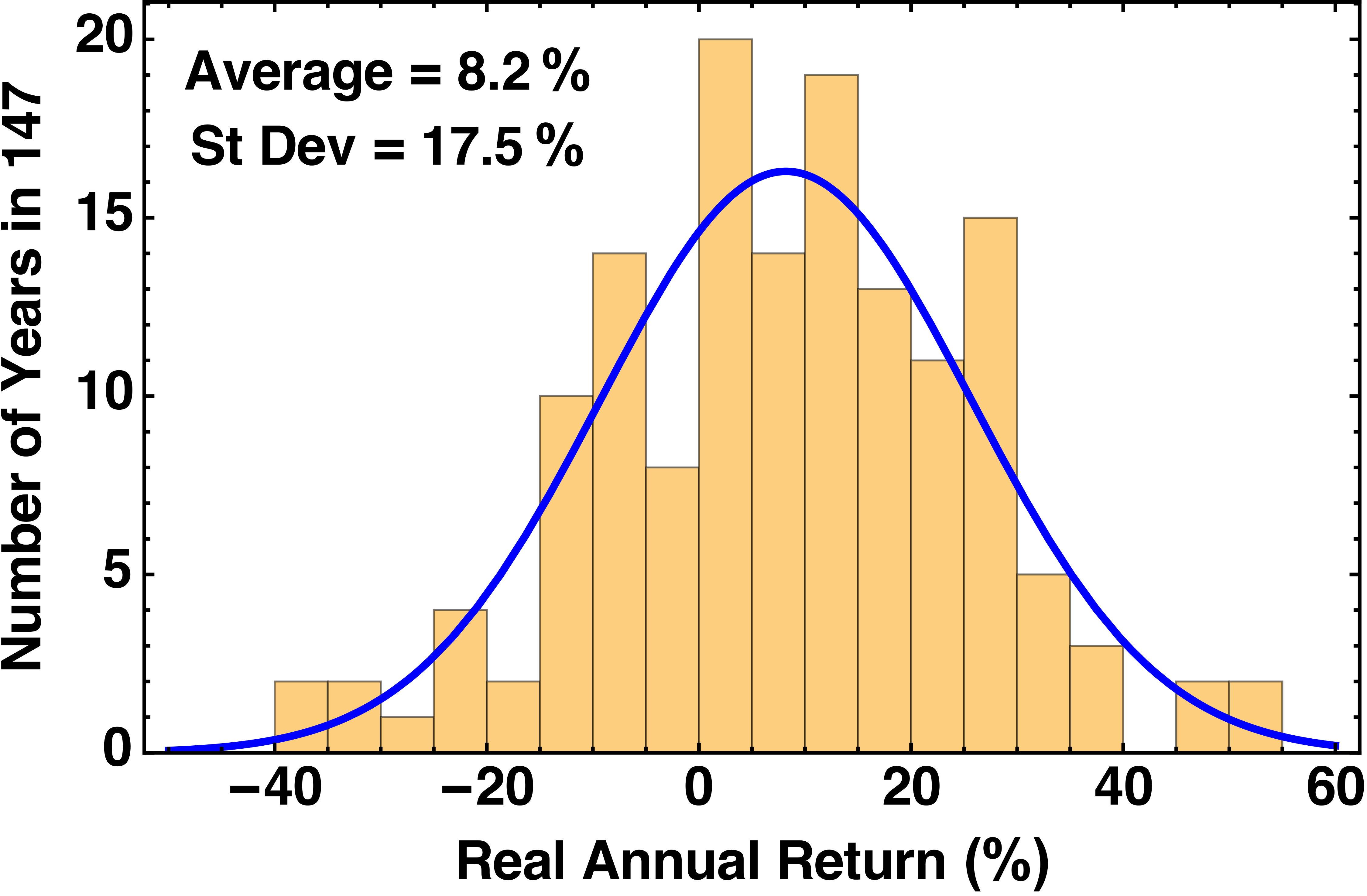

0546 PM ET 01302013. A cumulative histogram made by the author with Matplotlib. Ad New And Experienced Investors Should Consider These Top-Recommended Brokerages.

The city of Monte Carlo in the country of Monaco has long. Our Monte Carlo retirement calculator runs 1000 scenarios where the rates of return for every investment changes in each year. Planning Your Retirement Using The Monte Carlo Simulation.

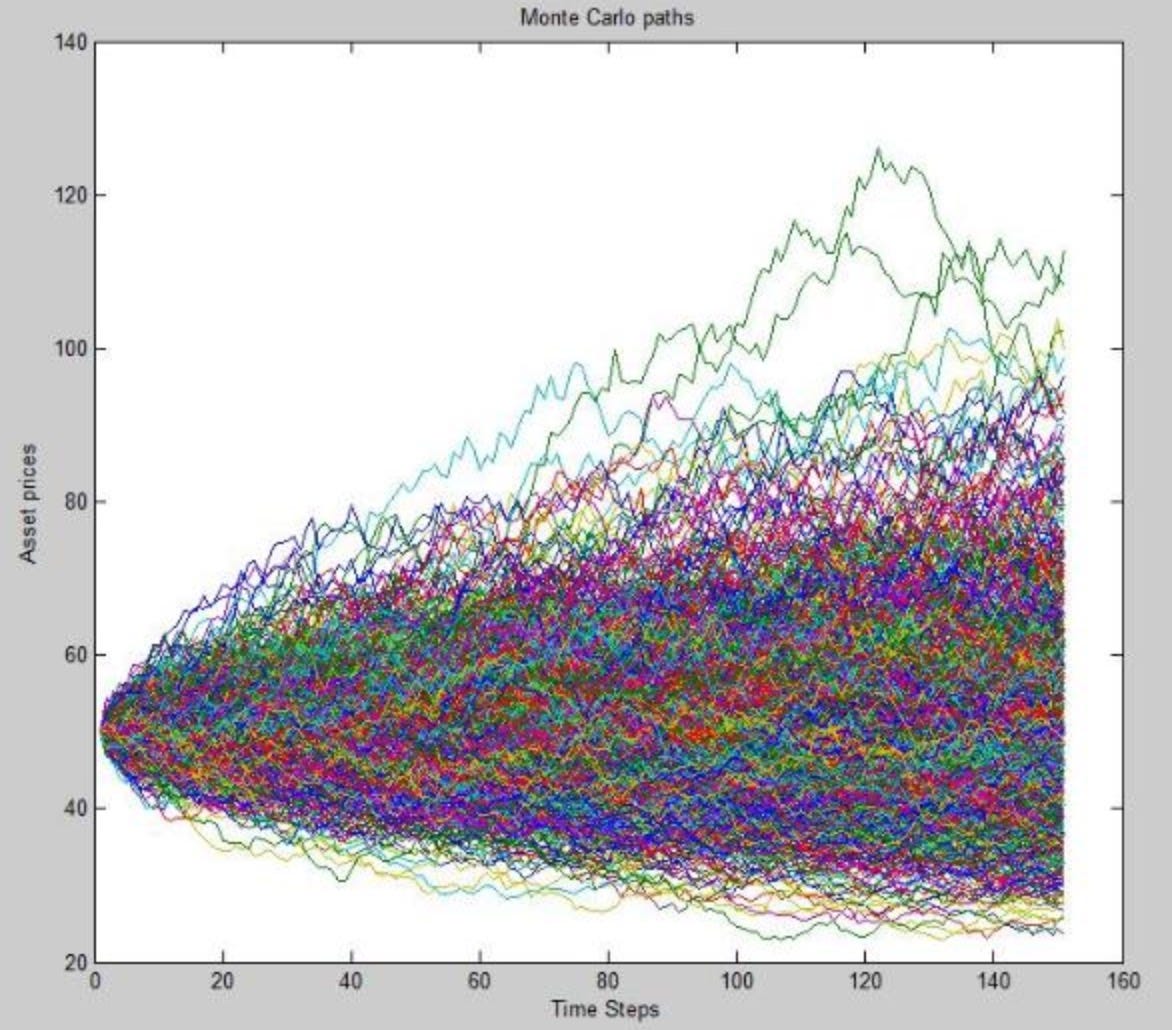

Monte Carlo Retirement Calculator. A Monte Carlo simulation models the probability of different results in a way that cant simply be projected because of the intervening of random variables. A Monte Carlo simulation is a mathematical technique used by investors and others to estimate the probability of different outcomes given a situation where multiple.

Now lets define that. Computer programs use this method to analyze past data and predict a range. Current Savings Annual Deposits Annual.

BUY LOCAL Monte Carlo Fans and Accessories are available at fine lighting and ceiling fan showrooms throughout North America. Monte Carlo simulation is a statistical technique by which a quantity is calculated repeatedly using randomly selected what-if scenarios for each calculation. Learn How We Can Help.

Choose Investments Using 0 Online Stock and ETF Trades. The main ideas behind the Monte Carlo simulation are the repeated random sampling of inputs of the random variable and the aggregation of the results. Partners Insight search Search Box.

This online Monte Carlo simulation tool provides a means to test long term expected portfolio growth and portfolio survival during retirement withdrawals ie. Our partner showrooms and retailers will help you find. Discounted cash flow DCF is a MONTE CARLO SIMULATION IN EXCEL WITHOUT USING ADD-INS valuation method used to estimate the value of an investment based on its future cash.

Start Growing Your Savings With Research Tools Provided By These Top-Reviewed Brokerages. Now we can numerically assess the risk associated with our investment project.

Why Monte Carlo Simulations Can Be Misleading Twp Financial

A 20 Day Monte Carlo Simulation For Stock Price Prediction The Example Download Scientific Diagram

Monte Carlo Simulating Opus Banks Stock Price I 440 Analytics

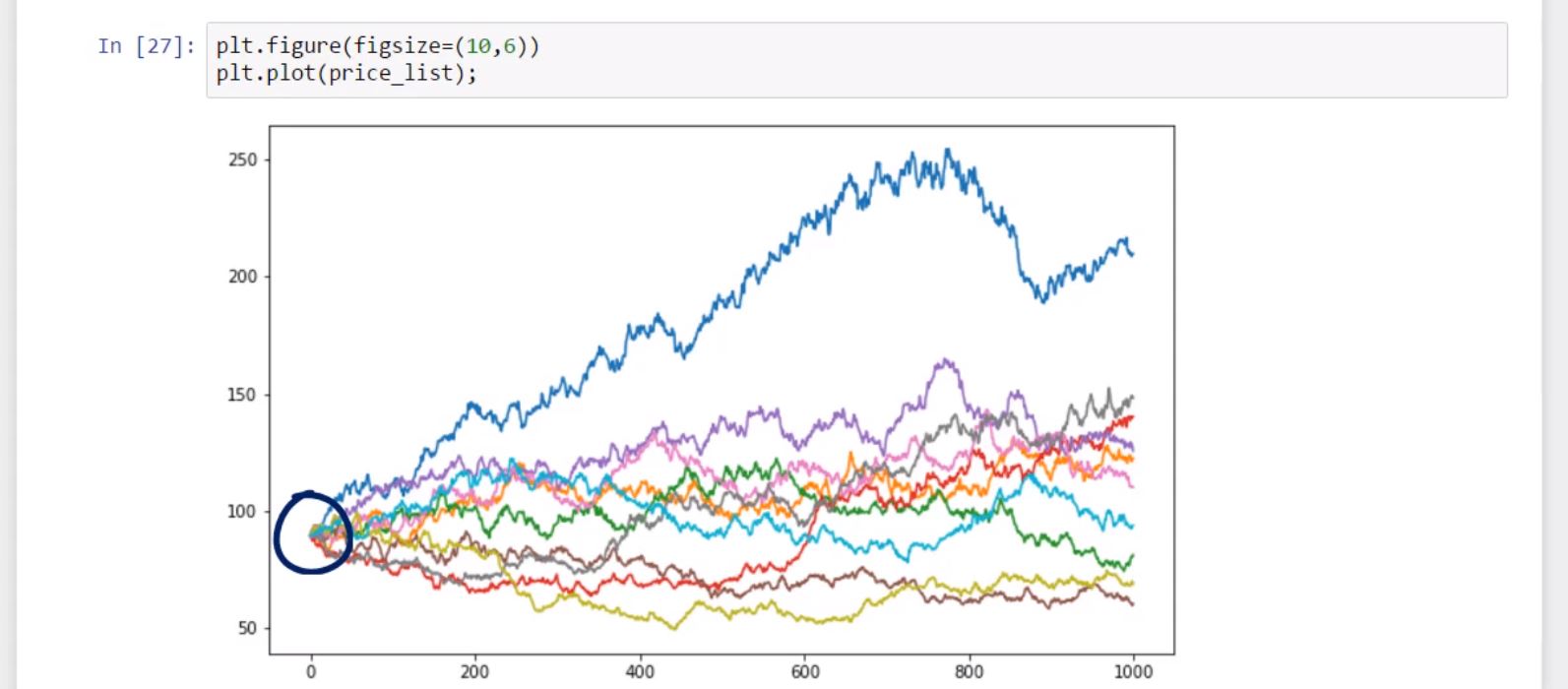

Monte Carlo Simulation In R With Focus On Option Pricing By Ojasvin Sood Towards Data Science

Estimation Of Portfolio Sip Return Using Monte Carlo Python By Aadhunik Sharma Medium

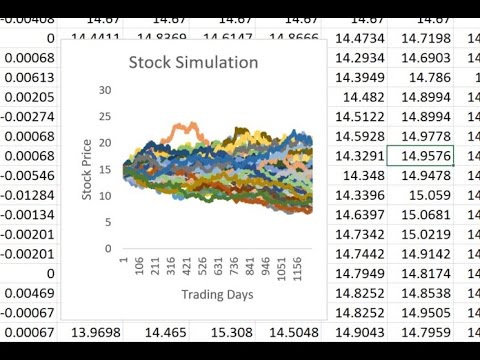

Simple Monte Carlo Simulation Of Stock Prices With Python Youtube

Monte Carlo Modeling In Personal Finance The Whoops Factor

A 20 Day Monte Carlo Simulation For Stock Price Prediction The Example Download Scientific Diagram

What Good Are Monte Carlo Simulations Anyway Seeking Alpha

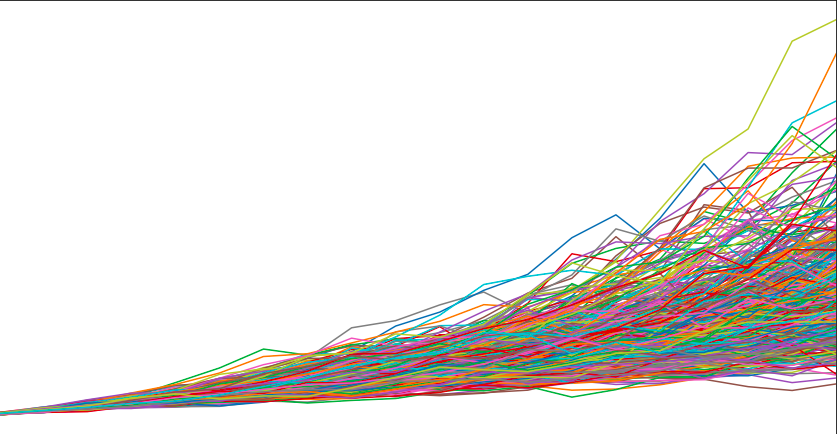

How To Apply Monte Carlo Simulation To Forecast Stock Prices Using Python Datascience

3 Of Many Uses For Monte Carlo Simulations In Trading See It Market

Monte Carlo Simulation Advanced Investing Equities Lab

Monte Carlo Simulation Of Stock Price Movement Youtube

Monte Carlo Simulation Excel

Stock Price Simulation Using Monte Carlo Methods Alteryx Community

Using Monte Carlo Simulations To Settle Equitable Distribution Mycollaborativeteam Com

An Overview Of Monte Carlo Methods By Christopher Pease Towards Data Science